Pay Aaa Car Insurance – AAA – Insights into car, home, insurance, money and travel insurance How to save on car insurance

Follow these simple steps to ensure you get the discount you deserve on your car insurance coverage.

Contents

- Pay Aaa Car Insurance

- Why You Should Consider A Aaa Membership, Even If You Don’t Have A Car

- Have You Reviewed Your Auto Insurance Declaration Page?

- Aaa Home Insurance Review 2023

- Does Your Aaa Membership Cover Rental Cars? Find Out!

- Does Aaa Cover Rental Cars?

- Aaa Backs Off Offering Home, Car Insurance To Florida Residents

- Aaa Vs. Geico Insurance Review: Cost And Coverage (2023)

Pay Aaa Car Insurance

Certain factors affect your car insurance premium such as location, age, driving record and the type of vehicle you drive. While there is little you can do to change your demographic profile, there are things you can do to help lower your costs, including choosing home and auto insurance packages. When looking for affordable car insurance, here are some ideas to consider.

Why You Should Consider A Aaa Membership, Even If You Don’t Have A Car

Coverage is subject to all policy terms, conditions, exclusions and limitations. Discounts and savings opportunities are subject to eligibility requirements. Subject to underwriting requirements. Insurance is written by one of the following companies: Auto Club Insurance Association, Member Select Insurance Company, Auto Club Group Insurance Company, Auto Club Property Casualty Insurance Company, Auto Club South Insurance Company, Florida Auto Club Insurance Company, Member Insurance Company and Universal Insurance Company . or unaffiliated insurance companies. ©2023 Auto Club Group. All rights reserved.

*AAADrive™ is not available in Colorado or North and South Carolina. AAADrive™ participation is optional. Subject to terms, conditions and availability. AAADrive car insurance discounts are not available in all states. Downloading the mobile app, activating AAADrive and being able to record trips are all required to receive the discount. Savings can vary and are based on driving behaviour. Discount applies to selected cover only and does not apply to statutory assessments and fixed expense fees. Discounts apply for select coverage only and may vary by state. The Ask an Agent series answers popular questions about car insurance with expert advice from AAA insurance agents. In this episode, agent Katrina Harrington discusses some of the pros and cons of mileage-based and standard premiums.

Harrington: With pay-per-mile insurance, you pay a base rate and then for every mile you drive, your insurance company charges you a certain amount — and it’s pennies or dollars, depending on the company. With pay-per-mile insurance, the more you drive, the higher the rate you can get. With traditional insurance, like the policies AAA offers, [you get] unlimited mileage. We do not charge for mileage at all. You can drive as much as you want, and your insurance will be the same price.

Harrington: Pay-per-mile insurance can be a good type of policy for someone who drives a lot, like a “snowbird” who comes to Arizona from [state] in the winter. They are only here part time. As long as they have a good driving record — as this can definitely affect your pay-per-mile — this is probably the way to go. But for those who drive to and from work every day, who travel, or who don’t have a great driving record (have had accidents or tickets), traditional insurance may be the best option. .

Have You Reviewed Your Auto Insurance Declaration Page?

Harrington: There are some downsides. Since these [policies] are [offered] by new insurance companies, they don’t have much experience with claims. Also, since they are new, we don’t really know their AM best rating. We don’t know how their customer service, claims and financial records are. Also, a lot of times with these companies, you have to put a device in your car [that] tracks where you’re driving and can also see driving habits like speeding and speeding. Some people want to stay away from it.

Harrington: AAA has a Best AM rating of A. We are financially stable. You can contact customer service 24/7, and we have instant claims service. I have AAA insurance, and I had to [file] a claim in person. AAA took me to the shop the same day, and my car was fixed within a week or two. AAA handles everything on the back end, so I don’t have to do much work myself. The claims rep I worked with was amazing and even checked in later to make sure everything was ok.

I recommend you research the insurance company before making the switch. You want to make sure you have someone looking for you instead of just trying to make a dollar. AAA is definitely there for our members.

Katrina Harrington joined AAA in 2012. She provided customer service to members in 22 states from AAA Insurance Group’s operations center in Glendale, Arizona before becoming an insurance agent. In 2017, he moved to the AAA Peoria branch. Editorial Note: This content has been researched and prepared by a team of expert reviewers. We may receive a commission from the links in this article but do not influence our advice or recommendations. learn again

Aaa Home Insurance Review 2023

Since many auto clubs join together to form AAA, you need to find AAA auto insurance reviews in your area.

Will has written for several major auto sites since 2020, logging hundreds of hours researching and testing products from child car seats to torque wrenches. Will is also certified as a Child Passenger Safety Technician (#T836339) by Safe Kids Worldwide.

AAA is made up of more than 50 individual businesses across the U.S. and customer satisfaction is high across the board. We rate AAA 4.0 out of 5.0 stars and the best auto insurance company for AAA members.

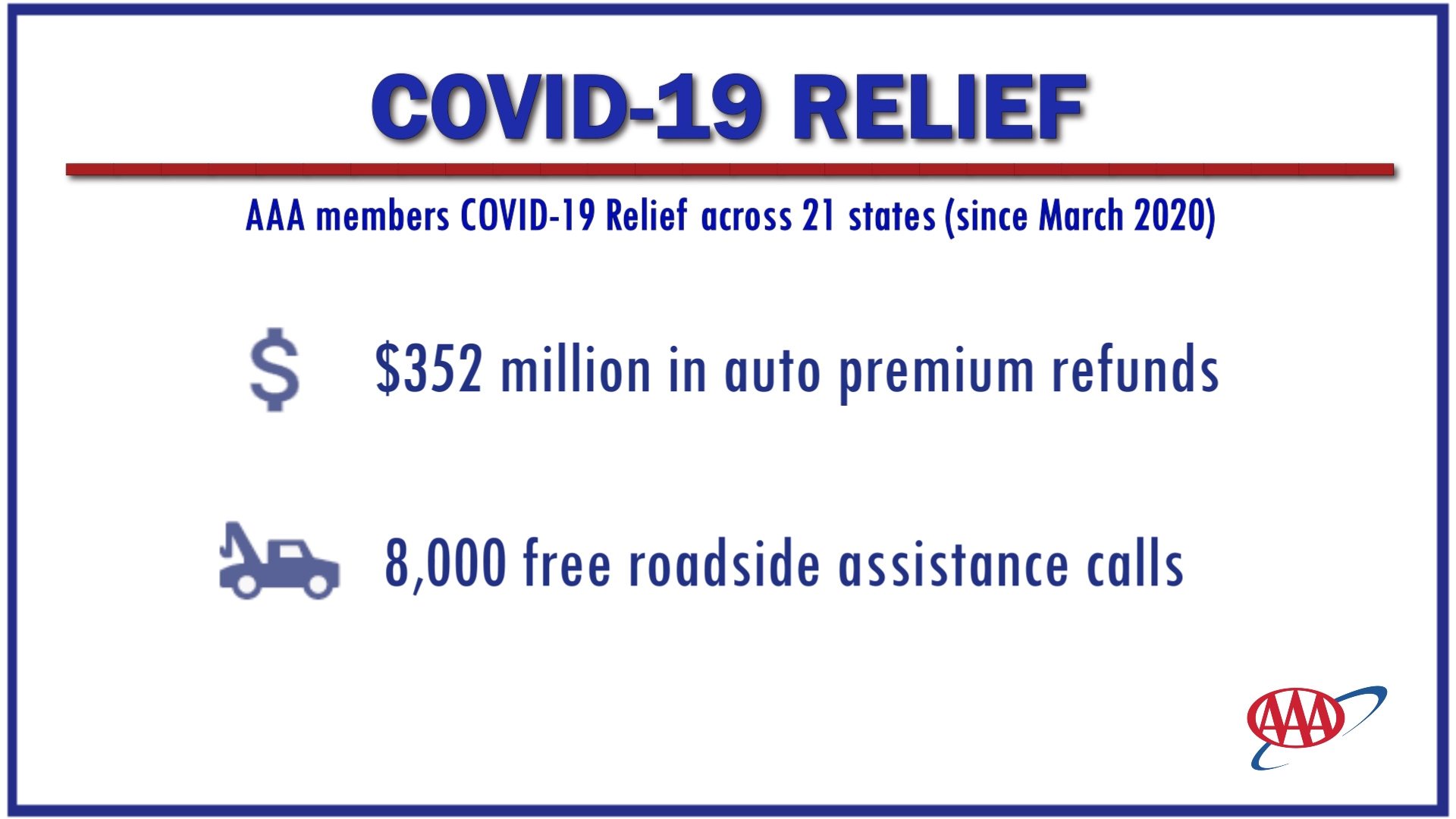

You may be familiar with AAA as a roadside assistance company, but did you know you can also get AAA car insurance? AAA insurance reviews tell us that protecting your vehicle with an auto policy can be worth the roadside assistance fee.

Does Your Aaa Membership Cover Rental Cars? Find Out!

As part of our research into the best auto insurance companies in the industry, we did a little digging into what AAA has to offer. AAA car insurance members have a good experience according to AAA reviews and can take advantage of some unique benefits.

But, we are dedicated to providing car owners with the well-researched information they need to make informed decisions about insuring their vehicles. Our editorial team consists of experienced automotive researchers, writers and editors who follow strict guidelines to ensure our articles are unbiased and fact-checked.

To compile our product reviews and ratings, our team regularly reviews over 40 car insurance companies to compare costs, coverage, availability and customer service. Because cost is important to most insurance shoppers, we compare thousands of insurance quotes using data from Quadrant Information Services. We also surveyed 8,000 car insurance consumers to find out what matters most to drivers when buying a policy. Finally, we look at the types of technology companies offer in terms of mobile app functionality and usage-based insurance programs.

AAA began in 1902 as the American Automobile Association. The association creates hotel maps and guides, as well as high school driving curricula and pedestrian safety programs. Today, it operates more than 1,000 travel agencies, rates accommodations and restaurants, publishes travel guides, and offers club member discounts at thousands of businesses.

Does Aaa Cover Rental Cars?

When we talk about AAA car insurance, we’re really talking about more than 50 individual businesses under the AAA umbrella. Each state may have its own independent AAA auto insurance company, and all companies operate under the same guidelines. However, coverage options and customer service may vary slightly by state. Most AAA insurance reviews, for example, are for individual locations rather than the company as a whole.

Because AAA is spread across several car insurance companies and groups, looking at just one doesn’t give you the whole picture. However, three of the AAA auto insurance groups appeared on the National Association of Insurance Commissioners (NAIC) list of the top 25 companies by insurance premiums written in 2018. Here are the stats:

If you add those three together, AAA’s total auto insurance premiums outpace the big players nationwide, according to the NAIC.

Among all the various AAA companies and groups, the insurance provider earns an excellent rating from AM Best for its financial strength, meaning that when it comes down to it, AAA insurance is able to pay claims. most likely.

Aaa Backs Off Offering Home, Car Insurance To Florida Residents

AAA auto insurance is available to AAA members, and it doesn’t cost much to become a member. You can get an AAA membership for about $50 to $100 a year.

While you can get AAA roadside service at any location, you can’t get AAA car insurance in every county. You must live in a county where AAA sells insurance plans directly. The easiest way to check this is to search online for coverage in your area.

Your local AAA club may have additional coverage options. For example, AAA car insurance plans through Auto Club South come in three categories: Essential, Advantage and Ultimate.

Check your local AAA club website and AAA car insurance reviews from customers in your area to see what may be available to you.

Aaa Vs. Geico Insurance Review: Cost And Coverage (2023)

One of the main benefits of AAA car insurance is that you can also enjoy AAA roadside assistance. AAA is a household name in roadside assistance, and the company offers solid coverage. This means you can take your car to a mechanic even if you haven’t been in an accident.

All AAA roadside assistance plans include towing, locksmith service, tire change, jump start, battery charge, fuel delivery and some trip breakdown assistance. The highest plan, Premier, expands.

Aaa life bill pay, aaa pay insurance, pay registration at aaa, aaa pay bill online, aaa michigan pay bill, aaa pay my bill, aaa car insurance pay online, pay my aaa insurance, aaa pay car insurance, aaa life insurance pay online, how to pay aaa insurance online, pay aaa life insurance