Allstate Insurance Beckley Wv – Home » Compare Car Insurance Rates by State » Compare West Virginia Car Insurance Rates » Compare West Virginia Car Insurance Rates [2023]

Compare West Virginia Auto Insurance Rates [2023] You can expect to pay an average of $86 per month to meet West Virginia’s 25/50/20 minimum auto insurance requirements for bodily injury and property damage. Learn more about West Virginia driving laws and how to get car insurance quotes to help you easily compare West Virginia car insurance rates.

Contents

- Allstate Insurance Beckley Wv

- Barber Shop Usa Hi Res Stock Photography And Images

- Top 10 Best Auto Insurance Near Spencer, Wv

- Tara Miller: Allstate Insurance, 920 S Eisenhower Dr, Beckley, Wv, Insurance Group

- July By Lisa Griffith

- Wvu Tech Fans Allowed Back Into Arena

- Top 10 Best Auto Insurance Near Daniels, Wv

- West Virginia University Women’s Soccer Guide By Joe Swan

- Salary: Appraiser In West Virginia (october, 2023)

- Top 10 Best Auto Insurance In Morgantown, Wv

- Best Car Insurance Companies In Texas

Allstate Insurance Beckley Wv

Rachel Bodine majored in English. Since working as an article writer in the insurance industry, she has gained a deep understanding of state and national insurance laws and rates. Her research and writing focuses on helping readers understand their insurance coverage and how to find savings. PhotoEnforced provides expert insurance advice. Featured on websites like All…

Barber Shop Usa Hi Res Stock Photography And Images

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a master’s degree in philosophy, Justin began his career as a professor, teaching philosophy and ethics. Later, Justin earned both his Property & Casualty and Life and Health licenses and began working for State Farm and Allstate. In 2020, Justin I…

Advertiser Disclosure: We are committed to helping you make informed auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any auto insurance company and cannot guarantee quotes from any individual company.

Our partners do not influence our content. Our opinions are ours. Enter your zip code above to use our free quote tool to compare quotes from the top automakers. The more you compare quotes, the more you compare. The greater the savings opportunities.

Editorial Guidelines: We are a free online resource for anyone who wants to learn more about auto insurance. Our goal is to be objective in everything related to auto insurance. Be a third-party resource. We update our site regularly and all content is reviewed by car insurance experts.

Top 10 Best Auto Insurance Near Spencer, Wv

Mountain State West Virginia with its mining towns; Known for his Appalachian music and his love of high school and college football.

Whether you’re traveling through the Blue Ridge Mountains or along the Shenandoah River, you’ll want to make sure you have the best West Virginia auto insurance coverage while driving on those country roads.

We know that finding coverage isn’t always easy and that there are many questions to answer. Is car insurance cheap in West Virginia? Who has the cheapest car insurance? What are the WV auto insurance laws?

The best way to ensure you get the right coverage at the best possible rates for your situation is to compare rates from the best auto insurance companies in West Virginia.

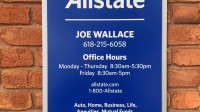

Tara Miller: Allstate Insurance, 920 S Eisenhower Dr, Beckley, Wv, Insurance Group

Whether you are Hatfield’s brood or a sprouting branch of the McCoy tree; If you reside in West Virginia, chances are you drive a lot. West Virginians travel approximately 14,283 miles per year. This is a smidge below the national average of 14,485.

With shorter-than-average commute times, Mountain State residents travel less than their fellow drivers on the East Coast.

Every mile driven is a potentially risky mile in the eyes of auto insurers. You need the right amount of auto insurance to mitigate that risk.

There’s no need to worry. what is needed We will help you know what you might want and where you can find it at the best price.

July By Lisa Griffith

West Virginia is a “fault” state, meaning it follows a traditional fault-based system when it comes to financial liability for property damage and personal injury resulting from a collision.

Basic coverage in West Virginia increased in 2016 to the 25/50/20 minimum required for all motorists. This requires all car owners to have the following minimum level of liability insurance coverage.

Refusing to carry any form of uninsured/underinsured coverage means higher insurance protects you and your passengers if you are uninsured or in an accident.

If you have assets or future assets that you wish to protect; You may be willing to reconsider basic liability coverage or just the cheapest options. Everyone has financial circumstances that impact the insurance services they can afford and the insurers available to them.

Wvu Tech Fans Allowed Back Into Arena

You should increase your liability limits to the maximum optional offering of 100/300/50 and ensure that you are covered for an amount equal to the total value of your assets (the dollar value of your home, car, savings and investments ).

Keep in mind that basic coverage only provides you with liability protection. We will not pay for the repair or replacement of your car for an accident you cause.

If you are looking to repair or replace your car after an accident. Accident insurance and comprehensive car insurance coverage are worth the investment. These policies have a deductible system and pay based on the current value of your car, not necessarily the price you paid for your car.

Continues; Let’s take a look at how much a driver pays for car insurance in West Virginia. The actual amount you pay will vary from these amounts. However, the following figures will provide a solid foundation to build on.

Top 10 Best Auto Insurance Near Daniels, Wv

His success in the music and entertainment industry; When asked about longevity and wealth, hip-hop super-producer and entrepreneur Dr. Dre said, “It’s easy to make money, but it’s hard to keep it.”

The entertainer, born Andre Young, also said, “The two things that scare me are God and the IRS.”

Both of these quotes describe the concept and importance of disposable personal income (PPE), which is the money you keep after taxes and other expenses.

By law you are required to carry minimum basic coverage. Liability in a comprehensive auto insurance policy; Includes comprehensive and collision insurance. Here is the average cost of each:

West Virginia University Women’s Soccer Guide By Joe Swan

Now that we know some important facts about individual customers, let’s take a look at some important statistics about auto insurance companies themselves.

The insurance loss ratio is the insurance company’s loss on claims paid divided by premiums collected. A high loss ratio means that an insurance company has too many customers filing claims, which in turn will increase future premiums for all consumers.

Loss ratios are measures that insurers use to evaluate the profitability of their business or policies. The loss ratio is a number that can be used to identify performance – the lower the number, the better. The better the performance.

For example: Suppose the owner of a small car dealership pays an annual premium of $50,000 to insure his inventory. After that, a polar storm causes a business owner to file an insurance claim and lose $75,000 in damages. The insured’s annual loss ratio becomes $75,000 / $50,000, or 150%.

Salary: Appraiser In West Virginia (october, 2023)

According to the Insurance Information Institute; More than 10% of West Virginia drivers are uninsured; That’s the 32nd most in the United States. This statistic alone should make you reconsider opting out of optional (but recommended) uninsured motorist coverage.

Medical billing coverage is optional in West Virginia. Med Pay insurance covers whether the insured person or the other driver is at fault. This type of coverage can protect drivers from injuries caused by collisions due to the growing deer population in West Virginia.

Car insurance plans offered by companies like Metromile are gaining popularity every day. However, they are not currently available in West Virginia.

Another usage-based auto insurance (UBI) program is active and available to West Virginia residents. Programs like Allstate’s Drivewise or Progressive’s Snapshot offer discounts to drivers based on the number of trips driven and the length of the trip.

Top 10 Best Auto Insurance In Morgantown, Wv

Additionally, there are some alternative enhancements you can research to determine if any of them make sense in your situation.

September 20 In 1973, Billie Jean King defeated Bobby Riggs in straight sets in a gay tennis tournament nicknamed the “Battle of the Sexes.”

That victory on King’s tennis court was a blow to women’s rights and equality that extended beyond the world of competitive sports.

Unfortunately, this movement towards equality has yet to reach the auto insurance industry. On average, male drivers can afford better premium quotes than their female counterparts.

Best Car Insurance Companies In Texas

Using gender as the only independent variable, the same background; We compare rates for 25 year old drivers with location and driving history. Here’s what we found:

When we extended our research by comparing rates among 55-year-old men and women with the same driving history and demographic information; The fight for equality has never been better.

If Serena Williams and Naomi Osaka can beat the McEnroe brothers (John and Patrick) in doubles, We will get close to the same premium rates for male and female drivers. အာမခံလုပ်ငန်းသည် အမျိုးသမီးများအား စျေးသက ်သာသော ကားအာမခံနှုန်းထားများ ပေးလေ့ရှိသည်ဟု ကျွန်ုပ်တို့ထင်မြင်သကဲ့သို့ ဤသုတေသနမှရလဒ် များသည် ဆန့်ကျင်ဘက်ဖြစ်သည်။ အော်တိုအာမခံကုန်ကျစရိတ်

Safelite beckley wv, car insurance beckley wv, aarons beckley wv, dentist beckley wv, enterprise beckley wv, flower delivery beckley wv, psychiatrist beckley wv, hotels near beckley wv, fmrs beckley wv, best western beckley wv, honda beckley wv, cheap hotels beckley wv