Investment Banking Job Is – An investment bank is a financial services company that acts as an intermediary for large and complex financial transactions. Investment banks are often involved when a start-up company plans an initial public offering (IPO) and when a company joins competitors. He also has responsibilities as a consultant or financial advisor to large institutional clients such as pension funds.

International investment banks include JPMorgan Chase, Goldman Sachs, Morgan Stanley, Citigroup, Bank of America, Credit Suisse, and Deutsche Bank.

Contents

- Investment Banking Job Is

- Why Investment Banking Professionals Spend Long Hours In Job?

- Investment Banking Careers: The Complete Actionable Guide

- Career In Investment Banking: A Complete Guide On How To Build A Career In Investment Banking

- Essential Aspects To Know About M & A Investment Banking

- Investment Banking Hours: Everything You Need To Know

- Investment Banker Anschreiben Muster

- Management Consulting Vs Investment Banking: The Complete Guide

- Corporate & Investment Banking Job Description

- Challenges Of Modern Investment Banker Solved With Salesforce Fsc [free Guide]

Investment Banking Job Is

Many of these names also offer over-the-counter community banking and have categories that cater to the investment needs of net worth individuals.

Why Investment Banking Professionals Spend Long Hours In Job?

Investment banking advisory services are fee-for-service. The marketing department earns a commission based on its market performance. As noted, many also have retail branches that make money from consumers and businesses.

Investment banking professionals may have careers as financial advisors, brokers, or salespeople. A career in investment banking is rewarding but often comes with long hours and high levels of stress.

An investment bank is known for its work as an intermediary between a company and the stock market. That is, they help companies issue IPO shares or issue additional shares. They also arrange corporate financing by looking for large corporate bond investors.

The investment bank is responsible for examining the company’s accounts properly and issuing an opinion detailing the offer to investors before they buy securities.

Investment Banking Careers: The Complete Actionable Guide

The measure is useful for investment banks. A bank connected to the global financial community is likely to benefit from matching buyers and sellers, especially for one-time transactions.

As financial advisors to large institutional investors, investment banks can provide strategic advice on a variety of financial issues.

They accomplish this task by combining a deep understanding of their clients’ goals, industry and global markets with the strategic vision needed to anticipate and assess short- and long-term opportunities and challenges.

An investment banker estimates the value of a potential purchase and helps negotiate a fair price. It also helps structure and facilitate procurement so that deals go smoothly.

Career In Investment Banking: A Complete Guide On How To Build A Career In Investment Banking

Investment banks have research departments that analyze companies and write reports on their futures, often buy, hold, or sell. This research may not generate direct income but it helps marketers and sales department.

The research department also provides investment advice to overseas customers who can complete business transactions through the bank’s trading desk, which can generate income for the bank.

Research maintains the knowledge of investment banking institutions in credit research, fixed income research, macroeconomic research, and quantitative analysis, which is used internally and externally to advise clients.

Size is an advantage in the investment banking business, where major investment banks rely on global networks to match buyers and sellers.

Essential Aspects To Know About M & A Investment Banking

Investment banks advise foreign clients in part and exchange their personal accounts for others. This could be a conflict of interest.

To avoid this, the investment bank must protect the so-called Chinese wall between the sectors. This symbolic barrier is designed to prevent the sharing of information that allows one party to gain an unfair advantage at the expense of their customers.

It requires writers to use primary sources to support their work. These include white papers, government data, background reports, and interviews with industry experts. We also refer to original research from other reputable publishers where appropriate. You can learn more about our standards for producing accurate and fair content in our publishing policy.

The services listed in this table are from partners who receive compensation. This delay may affect how and where listings appear. It does not include all the services available in the market.

Investment Banking Hours: Everything You Need To Know

By clicking “Exclude All Cookies”, you consent to the storage of cookies on your device to improve website traffic, analyze website usage, and assist our marketing efforts. concerning the raising of capital of companies, governments, other companies.

Examples of investment banking users are Goldman Sachs (GS), Morgan Stanley (MS), JPMorgan Chase (JPM), Bank of America Merrill Lynch (BAC), and Deutsche Bank (DB).

Investment banks facilitate large and complex financial transactions. Transactions may include acquisitions, mergers, or sales of customers. Another role of investment banks is to issue bonds to raise money. This includes creating detailed documents for the Securities and Exchange Commission (SEC) required for a company to go public.

Investment banks can save clients time and money by identifying potential risks in a particular project before the company moves forward. In theory, investment bankers are experts in their field or industry, who have their finger on the heart of the current investment climate. Businesses and non-profit institutions often turn to investment banks for advice on how to best plan their development.

Investment Banker Anschreiben Muster

Investment banks also help with financial instruments in terms of costs and legal requirements. When a company conducts an initial public offering (IPO), an investment bank will directly buy part or most of the company, acting as an intermediary. In this case, on behalf of the company going public, the investment banker will then sell the company’s stock in the public market, creating quick cash.

Investment banks take advantage of this situation, generally by placing brand shares. By doing so, investment banks are taking a huge risk. Although the experienced analysts of the investment bank use their experience to value the stock correctly, the investment bank can lose money on the deal if the stock is undervalued.

For example, suppose that Pete’s Paints Co., a paint and other supply chain, wants to advertise to the public. Pete, the owner, is in contact with Katherine, a famous investment banker. Pete and Katherine enter into an agreement in which Katherine agrees (on behalf of her company) to purchase 100,000 shares of Pete’s Paints in the company’s IPO at a price of $24 per share, based on the analyst’s recommendation. The investment bank is paying $2.4 million for 100,000 shares.

After filing the appropriate documents, such as SEC Form S-1, and setting the IPO date and time, Katherine and her team began to sell in the open market at $ 26. per share. However, the Investment Bank could not sell more than 20% at this price due to weak demand, and was forced to lower the price to $23 to sell the rest. This leads to a defeat for Katherine and her team.

Management Consulting Vs Investment Banking: The Complete Guide

The investment banking sector is popular because investment banks are often well paid. However, these positions require specific skills, such as excellent math skills, strong verbal and written skills, and the ability to work long, demanding hours.

Education requirements typically include an MBA from an accredited institution and possibly a chartered accountant (CFA).

Investment banks must follow a code of conduct established by their company and often sign confidentiality agreements due to the sensitive nature of the information they receive. Moreover, there is a possibility of conflict if the advisory and commercial departments of investment banks are linked.

There is a general hierarchy in investment banking: (from junior to senior) analyst, partner, vice president, senior vice president, and then managing director.

Corporate & Investment Banking Job Description

The services listed in this table are from partners who receive compensation. This delay may affect how and where listings appear. It does not include all the services available in the market.

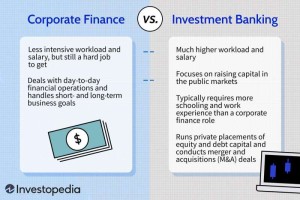

By clicking “Exclude All Cookies”, you consent to the storage of cookies on your device to improve website traffic, analyze website usage, and assist our marketing efforts. do it in very different ways. Investment banks acquire companies and then go to the stock market looking for ways to raise money from the investment public. Private companies, on the other hand, raise capital and seek investment from other companies.

Investment banking is a special branch of banking that deals in creating capital for other companies, governments and other institutions. assistance in the sale of securities; and helps facilitate mergers and acquisitions, restructuring and brokerage sales to institutional and individual investors. Investment banks also provide guidance to service providers regarding the issuance and placement of shares. Investment banking positions include consultants, banking analysts, stock market analysts, research associates, marketing specialists, and more. Everyone needs their own knowledge and skills.

A degree in finance, economics, accounting, or mathematics is a good start to any career in banking. In fact, it may be what you need for many commercial banking positions, such as private banking or brokerage. Those interested in investment banking should strongly consider pursuing a Master of Business Administration (MBA) or other professional degree.

Challenges Of Modern Investment Banker Solved With Salesforce Fsc [free Guide]

Good people skills are a big plus in any banking position. Although preserved

Investment banking job description analyst, job openings in investment banking, job opportunities in investment banking, investment banking, investment banking graduate job, real estate investment banking job, investment banking analyst job requirements, what exactly is investment banking, investment banking job, investment banking associate job, investment banking job listings, investment banking analyst job openings