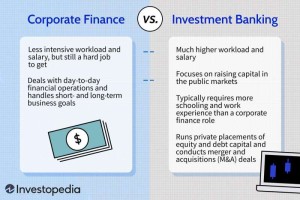

Investment Banking Jobs Description – Investment banking develops a company from a capital perspective, while corporate finance manages a company’s capital and strategic finance-related decisions. An investment banker raises capital in the public markets, manages private equity and debt capital investments, and conducts mergers and acquisitions (M&A). A corporate finance professional handles day-to-day financial operations and short-term and long-term business goals.

Investment banks raise capital for other companies through securities transactions in the debt and equity markets. Investment banks also help coordinate and execute mergers and acquisitions (M&A). They offer consulting services to large clients and perform complex financial analyses.

Contents

- Investment Banking Jobs Description

- Investmentbanker • Aufgaben Und Freie Stellen · [mit Video]

- Investment Banking Overview: Hierarchy, Career, And Application Guide

- Investment Banking Vs. Commercial Banking: What’s The Difference?

- Investment Bankers Work From Home

- What Skills Do Investment Banking Analysts Need?

- Investment Banker Job Description

- Investment Banking Resume Examples For 2023

- Merchant Banking Vs Investment Banking

Investment Banking Jobs Description

Investment banking is considered one of the main areas of the financial sector. In their bachelor’s degree, those interested in becoming an investment banker should focus on finance, economics, business administration, banking or statistics. Most people do internships or low-level positions at big banks to gain experience, and many work as analysts before getting an MBA.

Investmentbanker • Aufgaben Und Freie Stellen · [mit Video]

This career may be best for individuals with strong analytical skills who can use persuasive interpersonal communication and sales techniques while also being aware of regulations.

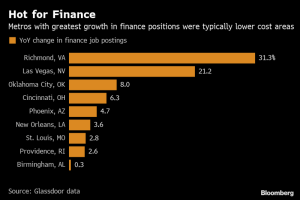

North America accounted for 46% of the global investment banking market in 2020, according to the Investment Banking Council of America.

Corporate finance is an umbrella term for any business division that deals with the financial activities of a company. There are many different career paths in corporate finance because there are many different types of jobs. Individuals can find their places in:

Entry-level positions are available for those without a college degree in business, while a graduate degree is more appropriate for mid- and senior-level positions. Of course, you must have certain necessary qualities, including a strong aptitude for mathematics and effective communication skills.

Investment Banking Overview: Hierarchy, Career, And Application Guide

It can sometimes be difficult to distinguish corporate finance functions from investment banking functions. For example, an investment banking firm may have a corporate finance division. And both careers can handle mergers and acquisitions depending on the individual’s role.

If you’re considering a career in investment banking or corporate finance, consider two key differentiators: workload and salary.

The prestige and salaries of investment banking jobs are attractive to many, so the intense hours are a small hurdle to overcome. The workflow is bottom-up, and those on the lowest rungs are responsible for the extra effort. Stories abound of investment analysts and associates working much longer than the typical 40-hour week.

Corporate finance jobs are more plentiful and less competitive than investment banking jobs. Corporate finance still offers an excellent career in business analysis and corporate culture for those who value weekends, holidays and evenings.

Investment Banking Vs. Commercial Banking: What’s The Difference?

In the field of corporate finance, a financial analyst could expect a median salary of $95,570 in 2021 (the most recent data available), according to the Bureau of Labor Statistics (BLS). However, CEO and other top corporate finance professionals had a median salary of $179,520 in 2021, according to the BLS.

A US-based investment banker could earn substantial sums. The McCombs School of Business at the University of Texas at Austin noted that the median income of MBA graduates working in investment banking was approximately $147,381.

Corporate banking is different from investment banking. Corporate banking involves the provision of various financial services to businesses. Corporate banking is a long-term relationship that includes traditional banking services, risk management and corporate finance services. Investment banking, on the other hand, is transactional and helps companies with one-time transactions such as an initial public offering (IPO).

In general, corporate finance is not considered a good route into investment banking. Corporate finance functions include budgeting, operations, cash management, planning and accounting. Corporate finance roles do not involve the same skills required in investment banking, such as financial modeling and valuation.

Investment Bankers Work From Home

Investment banking has two main functions. First, to help companies raise capital through initial public offerings (IPOs). Second, investment bankers help companies with mergers and acquisitions. Investment bankers analyze companies, perform valuations, perform financial modeling and evaluate financial statements.

Corporate finance and investment banking offer careers that can lead to success in corporate finance, especially when it comes to raising capital. When considering these two jobs, keep in mind that both professions are at risk of significant change due to advances in technology, including artificial intelligence, data science, and computing power.

Requires authors to use primary sources to support their work. This includes white papers, government data, original reports and interviews with industry experts. Where appropriate, we also link to original research from other reputable publishers. You can learn more about the standards we adhere to in creating accurate and unbiased content in our editorial policy.

The offers listed in this table come from partnerships from which you receive compensation. This compensation can affect how and where listings are displayed. does not include all offers available on the market.

What Skills Do Investment Banking Analysts Need?

By clicking “Accept all cookies” you consent to the storage of cookies on your device to improve site navigation, analyze site usage and assist with our marketing efforts. So, do you want a job offer in investment banking? And you’re ready to put in the effort to become an investment banker. Then you are on the right track. Getting a job in investment banking is very competitive and you may have worked hard not only to get your grades but also to technically improve your financial skills. This article outlines five key steps to getting a job offer in investment banking.

This investment banking jobs article covers everything but goes into detail in certain parts. You may need to check out some previous articles for more information.

First, understand the business of investment banking. Investment banks provide consulting services in the field of equity research, credit research, mergers and acquisitions; investment banks trade securities on behalf of their clients. In addition, investment banks act as prime brokers as well as custodians. You need to study and research to understand the investment banking business. Once you know your business, it’s easy to get into it. Find out more about investment banking here.

Also emphasize something important when recruiting. Investment banks are always looking for smart and talented candidates. They want to create a pool of talented people to make more money.” Money means investment banks and investment banks mean money.” Investment banks strongly prefer IITs, IIMs and top business school students because of their name, talent and style of education. If you don’t have IIT or IIM experience, don’t worry either!!! One thing to always keep in mind is “They are always looking for talent”. If you have the courage and talent, no one will stop you from doing it.

Investment Banker Job Description

So you have an idea of an investment bank and its business. In addition, there are two vacancies for entry level candidates. The first is an analyst or research analyst and the second is an associate. Now it’s your turn – how do you get in? Do your research and plan your strategy. So let’s understand what you need to do:

An internship in investment banking is a unique opportunity to become a member of an investment bank. Most investment banks offer summer internships for MBAs and have various graduate programs. Visit any investment bank’s website (see the list of top investment banks), go to the careers section of any investment bank and get all the information about summer internship opportunities and programs. However, the following basic skills are required to become an investment banker.

When you apply for a summer internship or are selected for an analyst position, your role is not limited to

So first check the investment banking jobs profile and hone your skills as per the profile requirements.

Investment Banking Resume Examples For 2023

The main function of a resume is to get you an interview. Your investment banking resume is a mirror to the investment banker and reflects your entire personality. An investment banking resume should be one page long and well formatted. Avoid spelling mistakes; use an appropriate font. For more information, see the article Resume in investment banking.

This is a critical phase. Everyone likes a story. From childhood to adulthood, everyone is interested in hearing stories. There would be a rare individual on this planet who does not like stories. Therefore, it would be helpful if you could construct your story in such a way that the interviewer is also involved in your account. But remember not to exaggerate your story; it can give the wrong impression. You can create your own story in the following scenarios:

Investment bankers also like to hear stories; they are human beings. This is where your presentation is important. Your account must convince the bankers that you are the right candidate for the above positions.

The best way to crack an investment banking job interview is to follow the 3 P’s before you go for the interview. The three P’s are practice, practice and only practice. A great inspirational quote is “The more we sweat in peace, the less we bleed in war”, so try your best to practice interviews and succeed in the interview. Practice will make you perfect.

Merchant Banking Vs Investment Banking

Also, if you want to expand your knowledge to join an investment bank, you

Investment banking analyst description, investment banking job description analyst, investment banking jobs, investment banking jobs singapore, jobs like investment banking, graduate investment banking jobs, investment banking associate jobs, entry investment banking jobs, investment banking finance jobs, investment banking analyst jobs, remote investment banking jobs, investment banking internship jobs