Investment Banking Job Eligibility – Investment Banking is one of the fascinating areas in the financial world. Today, people all over the world are becoming investment bankers and want to pursue a career in investment banking. If you are reading this right now, Chances are you know how much investment banking demands when analysts work 100-hour weeks. You may be interested in more information about Investment Banking. But for those who want to learn, let’s start with the basics from the blog we have compiled for you on how to make a salary and career in Investment Banking in India.

Generally speaking, an investment bank is a corporation, A private company that provides financial and other related services to individuals and governments. It provides services such as raising financial capital by accepting or acting as the client’s agent in issuing securities. It facilitates companies involved in mergers and acquisitions (M&A), derivatives and equity trading; It can assist in related areas such as market development and FICC services. An investment bank differs from a commercial bank and a retail bank because it does not accept deposits. Aspirants can visit some of the famous investment banks below to pursue a career in Investment Banking.

Contents

- Investment Banking Job Eligibility

- Future Of Investment Banking In India

- Bank Teller Job Description [updated For 2023]

- Steps To Get Bank Job After Passing 12th Standard In India

- Career Mapper Training & Placement Services

- Investment Banker: Job Description & Average Salary

- Cfa Vs Cfp A Detailed Comparison & How To Choose The Best!

- Mba In Finance: Salary, Scope, Fees, Benefits, Career, Jobs, Syllabus, Eligibility

Investment Banking Job Eligibility

In general, While many millennials are attracted to this career field because of its prestige and earning potential, it shouldn’t be the main factor in their ambitions. Those entering investment banking usually need to be pragmatic and think outside the box for innovative purposes. Below are some reasons why investment banking may be a good choice for you as a service provider:

Future Of Investment Banking In India

A career in Investment Banking requires education; the aim, networking; It’s a multi-step process that requires hard work and sometimes smart work. So, if you are passionate enough to pursue a career in Investment Banking, then continue reading the points discussed below.

The investment banking industry is highly competitive. Completing a specialist program in a uniquely connected stream makes a student a perfect candidate for a job. Check out popular investment banking courses to consider.

Investment bankers are in high demand worldwide. We’ve compiled a list of the best business schools that will bring you one step closer to your dream of becoming an investment banker.

There are many courses you can take to build your career as an investment banker. Management courses are available in countless colleges in India. Here is the list of top colleges in India for you.

Bank Teller Job Description [updated For 2023]

To prepare yourself for the investment banking industry; I recommend starting undergraduate level courses using college level teaching materials and books. On the other hand, Candidates for intermediate level and MBA programs should refer books on MBA entrance exam. Here is a list of books to study to prepare your skills for an investment banking interview.

Investment banker is one of the most in-demand careers and one of the contributing factors is the high paying jobs. Here is the basic salary of an investment banker in India and abroad

We hope you find our blog useful for investment bankers salary and career in investment banking in India and abroad. If you are passionate about becoming an investment banker, contact a Leverage Edu expert today and bridge the gap between your dream and reality. We have the most experienced and successful investment bankers to guide you in the investment banking industry. Call 1800 57 2000 now for a free 30 minute consultation session. The moment we hear the term investment banking; All we can think of are high-paying and lucrative white-collar jobs. The term Investment Banking is synonymous with big pay. But what is Investment Banking all about? What is the nature of this work? What are the eligibility criteria for investment banking course? Who is best suited to this type of job profile? Let’s dig deeper into this area and understand it better.

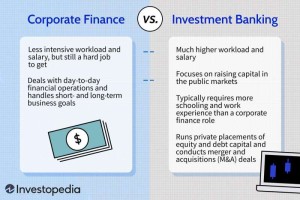

Investment banking is a niche in the financial world. Investment bankers specialize in handling complex transactions such as mergers and acquisitions and help institutions/organizations raise capital. Investment bankers buy; recovery; Debt collection restructuring; Assists in transactions such as debt issuance and equity. In this article, Investment banking will be understood as a career choice and the suitability of an investment banking course.

Steps To Get Bank Job After Passing 12th Standard In India

Investment banks are organizations that act as financial advisors to large institutional clients. They help their clients with complex financial transactions. They are their customers; their expectations; Conduct in-depth research on the mission and their goals and prepare an action plan to exploit available opportunities or overcome challenges faced by their clients.

Investment banks are large institutions; Organizations Governments etc. usually offer their services and they help their customers with their financial transactions and fundraising activities. They usually work on a commission basis. Being a specialized industry, investment banks usually have small teams and it is easier to offer higher packages to fewer employees.

The demand for professionals in this field is at an all-time high. The global investment banking market is estimated to reach approximately $138 billion by 2025. Hence, it is one of the most sought-after professions today.

An ideal candidate for this career has strong analytical skills and enjoys working with data and figures. Strong communication skills are an added advantage. Numerical and analytical mind is the core of this field.

Career Mapper Training & Placement Services

Apart from qualifying for an investment banking course, an aspirant must also consider the kind of skills required to succeed in this field. Let’s take a look at the required skills.

Whether you are eligible for the Investment Banking course. To find out You need to understand that the field you choose at undergraduate level does not matter much. However, finance accounting A degree in business or management helps.

At a later stage, investment banking; Master of Business Administration Chartered Financial Analyst Professional or university courses in Chartered Accountant etc. increase.

The applicant is expected to major in this field of accounting; taxes corporate finance; mathematics financial form; Must have in-depth knowledge of subjects such as economics. At entry level you start as an intern/junior analyst and progress to a senior analyst before moving into a manager position.

Investment Banker: Job Description & Average Salary

Goldman Sachs; JPMorgan; Morgan Stanley; Deutsche Bank Citigroup Credit Suisse; Institutions such as HSBC and Nomura are some of the most coveted names in investment banking. Today, India is the fifth largest economy in the world with a GDP of $3.7 trillion.

The rapid growth in the Indian industry has led to an increased focus on mergers and acquisitions. for example, The most talked about merger of HDFC Bank and mortgage lender HDFC Ltd is worth $40 billion alone. Similarly, A booming economy often witnesses many companies tapping the markets to raise capital through the IPO route.

By 2022, India will rank third in terms of number of IPOs. Such complex transactions create a need for specialists such as investment bankers. To understand the depth of this section, We need to look at the data shared by Refinitiv and the total volume of mergers and acquisitions in India by 2022 is approximately $172 billion.

For example: Zomato’s IPO by Bank of America; Citi Kotak Mahindra Capital; Supported by Credit Suisse and Morgan Stanley. Another example is Yes Bank’s capital raising in July 2020 when it raised its capital through the Follow On Public Offer (FPO) route. These banks issue debt and equity; It helps with restructuring etc.

Cfa Vs Cfp A Detailed Comparison & How To Choose The Best!

The nature of financial transactions is becoming more complex day by day and with digitalisation; This field is expected to expand soon. Advances in technology and increased integration of finance and technology will only lead to an increased demand for skilled professionals in this field. Investment banking is expected to become the third largest sector in the banking industry.

The prominent nature of this field arouses the interest of many young people. Investment banking is one of the highest paying jobs in the financial industry. Entry level can earn an average of INR 8 Lakhs to INR 10 Lakhs per annum. You can easily expect a salary of INR 30 lakhs and above at mid-level.

Other factors that influence pay include the candidate’s qualifications; experience and knowledge; The skill he displayed; including work location and employing organization. Investment Banker ဖြစ်ရန် လိုအပ်သော ကျွမ်းကျင်မှုများ၏ သဘောသဘာဝကြောင့် အလုပ်အကိုင် အခွင့်အလမ်း အရေအတွက်မှာလည်း အကန့်အသတ်ရှိသည်။

နည်းပညာပိုင်းဆိုင်ရာ ကျွမ်းကျင်မှုများအပြင် စံပြကိုယ်စားလှယ်လောင်းတစ်ဦးသည် အချိန်ကြာမြင့်စွာ အလုပ်လုပ်နိုင်သူ၊ ဖိအားများအောက်တွင် အလုပ်လုပ်ရာတွင် ကျွမ်းကျင်ပြီး ထိရောက်သော ဆက်သွယ်ပြောဆိုနိုင်သူဖြစ်ရမည်။ ဝန်ထမ်းများ၏ ပုံသေကုန်ကျစရိတ်များ သို့မဟုတ် Cost to the Company (CTC) အပြင် ဝင်ငွေ၏ အစိတ်အပိုင်းများစွာကို ထုတ်ပေးပါသည်။

Mba In Finance: Salary, Scope, Fees, Benefits, Career, Jobs, Syllabus, Eligibility

Job openings in investment banking, usaa banking eligibility, investment banking associate job, job opportunities in investment banking, investment banking analyst job requirements, investment banking job listings, investment banking analyst job openings, investment banking job, investment banking graduate job, real estate investment banking job, investment banking, investment banking job description analyst