Aarp Supplemental Medicare Insurance – UnitedHealthcare sells Medicare Advantage plans on behalf of its affiliate organization, AARP. Plan N is one of the supplemental insurance plans (also called Medigap) available through AARP/UnitedHealthcare.

In this Plan N review, we review details about what Medicare pays, how much it costs, AARP/UnitedHealthcare customer reviews and financial eligibility levels, enrollment information and more so you can find the right Medigap plan. . more for your local needs.

Contents

- Aarp Supplemental Medicare Insurance

- Medicare Supplement (medigap) Plan F Benefits And Coverage

- Aarp Medicare Plans: A Comprehensive Overview

- Best Medicare Supplement (medigap) Companies

- Aarp Medicare Supplement ≡ Fill Out Printable Pdf Forms Online

- An Overview Of Aarp Medicare Supplement Plans

- Save Money With An Aarp Medicare Supplement Insurance Plan

- Aarp® — Arsenal Brand Design

- Medicare Plan F Vs Plan G Vs Plan N

Aarp Supplemental Medicare Insurance

Supplemental Medicare plans are insurance plans that can be used in conjunction with original Medicare (Part A and Part B) to fill coverage gaps in certain areas. Medigap plans help pay for your Part A and Part B copayments, deductibles and more.

Medicare Supplement (medigap) Plan F Benefits And Coverage

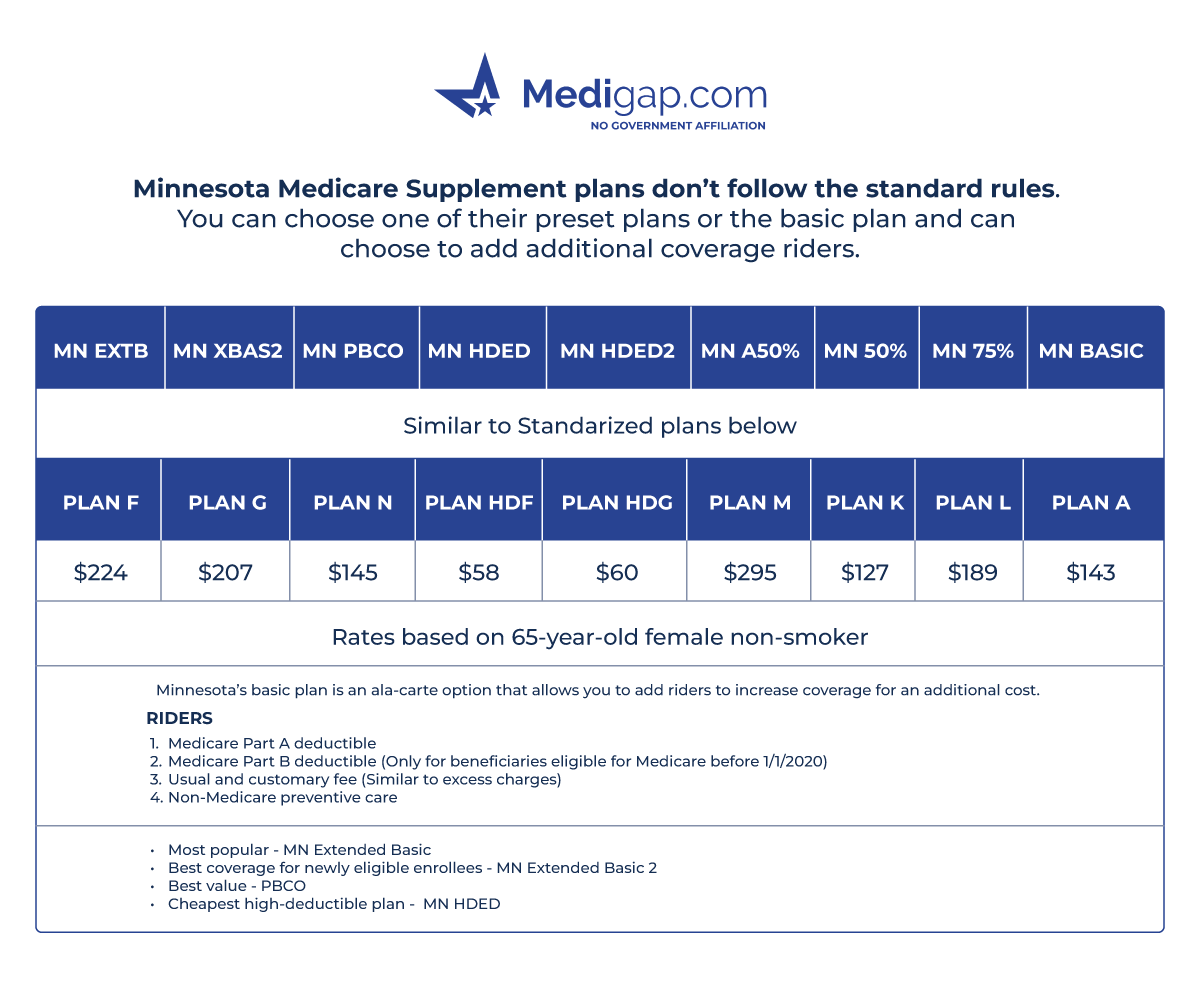

Medigap Plan N is one of 10 Medigap plans available in many states, each of which includes a set of benefits that are standardized across states and carriers. That means AARP Plan N in Florida will cover the same Medicare costs as AARP Plan N in Texas, although the plan size and premiums may be different.

1. Plans C and F are not available to new beneficiaries who are eligible for Medicare on or after January 1, 2020. 2. Plans F and G also offer high deductible plans with annual deductibles of $2,700 and 2023. Once every year the deductible is met, the plan pays 100% of the insured service for the remaining year. The Plan F premium is not available for new beneficiaries who are eligible for Medicare on or after January 1, 2020. 3. Plan K has an annual out-of-pocket cost of $6,490 per year 2023. Plan L has an annual limit. -out-of-pocket of $3,470 in 2023. 4. Plan N pays 100% of Part B coinsurance, except for copays of up to $20 for certain companies per year and up to $50 for emergency room visits without a response. inpatient admission. See a graphical version of this table.

Plan N is one of the most popular Medigap plans in 2022. It offers solid coverage at low rates. Below is a look at what AARP/UnitedHealthcare Medigap Plan N is.

AARP/UnitedHealthcare plans fully cover each of these Medicare costs unless otherwise noted. That means the plan pays for the full price of the item listed.

Aarp Medicare Plans: A Comprehensive Overview

Medicare Part A is charged a $1,600 deductible for each benefit period in 2023. You may receive more than one benefit period in a calendar year, which will require you to pay the $1,600 deductible more than once during the year.

Medicare Part A pays $400 per day for days 61-90 of a hospital stay in each benefit period in 2023, and $800 per day beyond 90 days.

Medicare Part B usually charges a 20% copayment for covered services after meeting the annual deductible.

With Plan N, you can be responsible for paying up to $20 for an office visit and up to $50 for an emergency room visit that does not result in an admission. Otherwise, your Part B payment or payment is Plan N.

Best Medicare Supplement (medigap) Companies

Hospital care under Part A requires a small copayment (not more than $5) for prescription drugs and other products used for pain relief and symptom management. Hospital respite care requires a 5% coinsurance.

Medicare Part A charges up to $200 per day for days 21-100 of skilled nursing care in 2023, with beneficiaries responsible for all costs over 100 days.

Only under certain conditions does Medicare provide any coverage for emergency care received outside the US. The scheme covers 80% of the cost of overseas travel medical care.

There are only two types of Medicare out-of-pocket expenses that may be covered by other Medigap plans but not by Plan N.

Aarp Medicare Supplement ≡ Fill Out Printable Pdf Forms Online

Using the AARP/UnitedHealthcare online application, we can find Medicare Plan options with monthly premiums ranging from $100 to $117 dollars per month.

In many places, AARP/UnitedHealthcare sells an enhanced version of Plan N called “Plan N+ wellness supplements.” For a higher monthly fee, these types of plans include discounts on dental, vision and hearing care, gym memberships and more.

Again, availability, costs and benefits may vary, so be sure to speak with a licensed insurance agent or request a free quote for a plan in your area.

One way to evaluate AARP/UnitedHealthcare Plan N is to compare it to Medicare Advantage plans like Plan G.

An Overview Of Aarp Medicare Supplement Plans

Plan G offers the most coverage to new Medicare beneficiaries, and the table below shows how it compares to Plan N.

You can enroll in the AARP/UnitedHealthcare Medigap Plan at any time of the year. However, the best time to sign up for a Medicare supplement plan is during your Medigap enrollment.

Your Medigap Enrollment Period (OEP) begins the day you turn 65 or older and enroll in Medicare Part A and Part B. Your OEP only lasts for six months, so it’s important to consider a plan before the OEP runs out. . ready to enter.

At the time of registration, you are guaranteed jurisdiction. When you get insurance, you will be exempt from any prescription drugs, and insurance carriers may not pay you high premiums or deny your coverage based on your health.

Save Money With An Aarp Medicare Supplement Insurance Plan

But if you wait to sign up until the enrollment period is over, you’ll be giving up your right to claim insurance and you could end up with higher bills if you’re unwell.

You can request a free online quote for Plan N and other Medigap plans for sale where you live and – if applicable – complete the enrollment process. You can also call to speak with a licensed representative to learn more about Plan N, to find rates near you and for enrollment assistance. An independent and objective Health editorial group. To help support our reporting services, and to continue our ability to provide free content to our readers, we receive commissions from companies that advertise on health sites. This compensation comes from two sources. First, we offer advertisers paid sites to display their offerings. The compensation we receive for those ads depends on how and where the advertisers’ offers appear on the site. This site does not include all companies or products in the market. Second, we also include links to advertisers’ contributions in some of our articles; These “affiliate links” may earn money for our site when you click on them.

The compensation we receive from advertisers does not affect the advice or recommendations our editorial team provides on our stories or influence any editorial content on Health. Although we strive to provide accurate and up-to-date information that we think you will find relevant, Health does not warrant that any information provided does not make any representations or warranties in connection therewith. , or for accuracy or interest. in it.

Commissions earned through affiliate links on this page do not reflect our opinions or ratings. Our editorial content is based on thorough research and guidance from our Advisory Board.

Aarp® — Arsenal Brand Design

Medicare will not cover all of your health care costs after you turn 65. Medicare Part A covers 80% of hospital care and skilled nursing facilities, and Medicare Part B covers 80% of hospital care and medical supplies. is important. For the 20% not covered by Medicare, you have the option of purchasing Medicare (Medigap) coverage from a private insurance company.

To find the best insurance providers, the Health News editorial team analyzed data on US insurance companies that offer nationwide plans by the number of states they offer coverage, the number of types of plans they offer, according to organize their finances. healthcare through companies like A.M. Beauty and others. Read on to see our list of suppliers.

Health’s editorial team values the accuracy and integrity of the data collected. Our position is based on quantitative data and has no conflict of interest. We carefully review the information displayed on our site and we intend to publish sites and other content about insurance providers that our readers can trust. You can read more about our editorial guidelines and our process for the situation below.

Affiliate offers the kind of features that pay Health to appear at the top of our list. Although this may affect where their products or services appear on our site, it does not affect our ranking in any way, which is based on thorough research, rigorous procedures and professional advice. Our partners cannot pay us to guarantee positive reviews of their products or services

Medicare Plan F Vs Plan G Vs Plan N

Ranked 42nd on the Fortune 500 list, Humana is one of the largest health insurance providers in the US and offers health insurance plans in several states, including Washington, DC, and Puerto Rico. In addition to its extensive Medigap offerings, Humana offers many member benefits such as SilverSneakers and meal deliveries. Humana’s supplemental coverage goes beyond the requirements for Medicare coverage, such as affordable options for dental care and vision care. Your game

Aarp medicare supplemental, aarp medicare supplemental insurance rates, aarp medicare supplemental insurance cost, aarp supplemental insurance plans, aarp recommended medicare supplemental insurance, aarp medicare supplemental insurance plans, aarp medicare supplemental insurance, aarp supplemental insurance cost, aarp medicare supplemental plan, aarp medicare supplemental insurance login, aarp supplemental dental insurance, aarp medicare supplemental plans