Aaa Insurance Tahlequah – The cheapest auto insurance companies in Oklahoma are State Farm, Geico and Progressive. The difference between the cheapest and most expensive auto insurance in Oklahoma is $1,903 per year, so it’s worth comparing quotes.

Finding cheap auto insurance in Oklahoma isn’t a tall order if you’re looking for the state’s minimum coverage. However, if you want full coverage car insurance, you will definitely want to shop around. Despite ranking 19th in our national cheap car insurance study, Oklahoma drivers pay more than most for comprehensive insurance. That’s because Oklahoma is in the famous Tornado Alley. Dozens of tornadoes tear through the state each year, leading to expensive claims.

Contents

- Aaa Insurance Tahlequah

- Osage, Other Casinos Opening; Cherokee, Creek Delayed

- Künstler / Musiker

- Opa Awards Program 2018 19 By Jgilliland

- The Best 10 Insurance Near Aaa Skiatook

- Aaa Business Systems’ Office Technology Client Testimonials

- Shop Adair County Crew Drawing Begins At 10 A.m. On Wednesday, Dec. 21 At Neo Health In Westville

- Icao Flughafen Codes Usa

- Congrats On Making It To State Cheer

Aaa Insurance Tahlequah

Comprehensive auto insurance protects against natural disasters and other events beyond the driver’s control, and is usually one of the cheapest types of optional coverage to add to a policy. But in Oklahoma, where many drivers file large comprehensive claims each year, comprehensive coverage costs almost as much as collision insurance, which is usually much more expensive. This increases the average cost of full coverage policies, causing Oklahoma residents to pay nearly $200 more each year than the national average.

Osage, Other Casinos Opening; Cherokee, Creek Delayed

The best way for Oklahoma drivers to save money on auto insurance is to compare quotes from multiple companies. Many Oklahoma drivers can save as much as $1,903 a year, or even more, just by shopping around and going with one of the cheapest rates listed. analyze quotes from all major insurance companies using multiple driver profiles and zip codes to help Oklahoma residents find the cheapest auto insurance. You can check out our recommendations below, as well as compare the cheapest options for the best auto insurance companies in Oklahoma to make sure you find the right fit for your specific needs.

State Farm has the cheapest auto insurance for most good drivers in Oklahoma. Drivers who have never had an accident or received a citation are considered good drivers by insurance companies and pay less for insurance than drivers with poor records. In addition to low rates, good drivers can often qualify for additional discounts from their insurance company.

Full coverage refers to a policy that goes beyond the state’s minimum requirements. As full coverage protects you in more situations, it costs more than the minimum requirements.

After a speeding ticket, most drivers will see their insurance rates increase for 3-5 years. It is important to remember that all insurance companies calculate prices differently, so you should always obtain several quotes to ensure you get the best deal.

Künstler / Musiker

An at-fault accident will usually negatively affect your insurance for 3-5 years, as insurance companies will consider you a high risk. Because of your higher prices, it’s even more important to comparison shop.

A low credit score often marks drivers as a higher risk, so insurers will usually charge them more for coverage. But because insurance companies use different formulas to calculate premiums, bad credit can affect your rates more with one company than another. As all insurance companies treat credit differently, it pays to compare offers.

As young drivers have less experience behind the wheel, insurance companies tend to charge higher rates than more mature drivers. On average, most drivers will see rates drop as they get older with a significant drop after they turn 25. Cheapest auto insurance in Oklahoma for older drivers

Although mature drivers pay less for car insurance than teenagers, older drivers begin to see rates rise as they reach their senior years. Comparing auto insurance rates can save older drivers hundreds of dollars a year.

Opa Awards Program 2018 19 By Jgilliland

Drivers with a DUI on their record typically experience much higher rates than drivers with a clean driving record or those with a history of less serious offenses. A DUI typically affects your insurance rates for 3-10 years, but the offense itself can stay on your driving record much longer than that.

To identify the cheapest post-DUI insurance companies, we matched rates for a 45-year-old single man with minimum insurance, a DUI and good credit across major insurance companies.

Married drivers usually enjoy cheaper car insurance rates than single drivers. In general, car insurance companies consider married drivers to be more responsible and less of a risk to insure. To help married drivers further reduce their insurance costs, major insurers reduced rates for a 45-year-old married man with minimum coverage, a clean driving record and good credit.

The cheapest auto insurance company in Oklahoma is State Farm, which charges an average of $50 per month for the state’s minimum coverage. In addition to being the cheapest auto insurance company for Oklahomans in general, it is the cheapest option for a number of specific categories, such as full coverage and good driver coverage.

The Best 10 Insurance Near Aaa Skiatook

6 tips on how to get cheap auto insurance in Oklahoma 1. Compare quotes from national and regional insurance companies

Don’t forget to include local insurance companies in your search for cheap car insurance. In Oklahoma, regional insurance companies such as Shelter, Auto-Owners Insurance and Farm Bureau Mutual may have lower rates than national companies such as Allstate, Geico and Travelers and have similar customer satisfaction ratings.

Everyone knows that your driving habits and accident history affect how much you pay for car insurance. But in Oklahoma, companies may also consider your age, gender, credit history, marital status and more when setting premiums. The car you drive, your annual mileage, and even some factors beyond your control all affect the price of insurance.

You need liability insurance to pay for the other driver’s injuries if you are at fault in an accident in Oklahoma. Collision and comprehensive coverage, on the other hand, is optional and may not be necessary if you own an older car. Usage-based insurance may be a better fit than a standard policy for low-mileage drivers, and going with a higher deductible or lower coverage limits also costs less. Don’t overlook the coverage you need, but make informed choices. This way you don’t pay for more car insurance than you need.

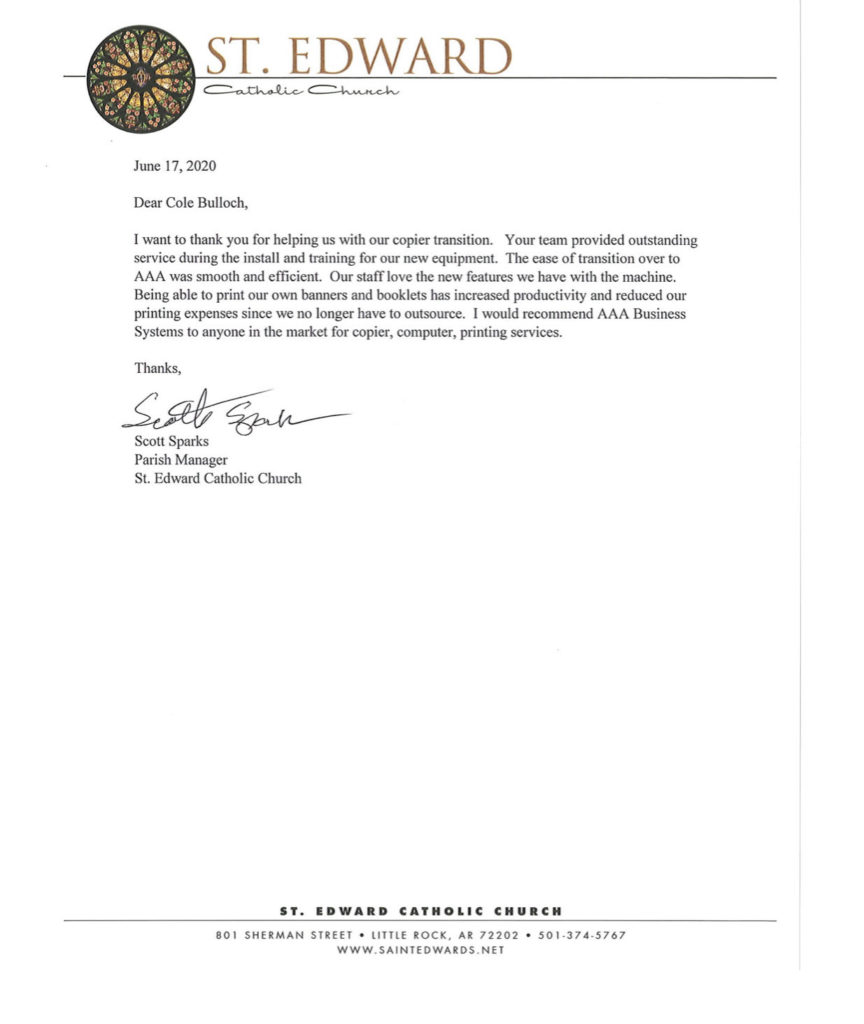

Aaa Business Systems’ Office Technology Client Testimonials

The best auto insurance companies in Oklahoma have a variety of discounts, so almost anyone can find ways to save. You may be able to get a discount if you are a student, veteran, good driver, homeowner, ready to go paperless and more.

It won’t lower the overall cost of your insurance, but comprehensive coverage can save you a lot of money in the long run. Oklahoma drivers should maintain comprehensive coverage to protect against natural disasters such as hurricanes. In 2019, Oklahoma set the record for most tornadoes in a year, with 149.

You’ll see higher rates if you let your insurance lapse, even if you don’t own a car. Oklahoma drivers who do not maintain continuous auto insurance pay an average of 5% more per year than those who have at least five consecutive years of insurance history.

An analysis of cheap auto insurance companies in Oklahoma is based on data from the Oklahoma DMV and Quadrant Information Services. Along with this data, we used the features listed below to create 40 different driver profiles designed to identify the cheapest auto insurance companies for Oklahoma drivers in a collection of key categories. For each profile, quotes are matched among the best auto insurance companies in Oklahoma by calculating average premiums from 35 zip codes that represent at least 20% of the Oklahoma population. Military-specific companies such as USAA were only considered for the military-specific category, due to their eligibility limitations. . In some cases, this may be the best option overall for qualified drivers.

Shop Adair County Crew Drawing Begins At 10 A.m. On Wednesday, Dec. 21 At Neo Health In Westville

In the table below, you can see all the profile characteristics used in the analysis, as well as the specific subset of characteristics that make up our Good Driver profile.

Clean, one speeding ticket, one at-fault accident, one DUI, suspended license, open container, red light violation, reckless driving, one at-fault accident

Where driver profiles are not specified, Oklahoma insurance quotes are averaged across 40 different driver profiles, using the above variables. Offer information is provided by Quadrant Information Services and is representative only. Individual prices will differ.

Finding the cheapest auto insurance in Oklahoma can be difficult. But you have the knowledgeable municipality on your side. Other users have a wealth of information to share, and we encourage everyone to do so while respecting our content guidelines.

Icao Flughafen Codes Usa

Auto insurance in Oklahoma costs an average of $43 per month or $511 per year for minimum coverage. The cheapest auto insurance companies in Oklahoma are USAA, State Farm, and Geico, and getting quotes from multiple companies can help you find the best deal.

The average cost of car insurance in Oklahoma is 24% lower than the national average car insurance premium. There are a number of factors that affect how much you pay for auto insurance in Oklahoma, including your…

Oklahoma drivers can get cheap auto insurance with “no deposit” or “no down payment,” but all that really means is that you only need to pay the first month’s premium to get coverage. You can’t get auto insurance in Oklahoma without paying something upfront.

The average premium in Oklahoma is about $374 per month for full coverage and about $104 per month for the state’s minimum coverage. Oklahoma drivers should expect to do so

Congrats On Making It To State Cheer

Farmers insurance tahlequah, insurance tahlequah ok, shelter insurance tahlequah, tahlequah insurance, aaa term life insurance, aaa rv insurance, aaa life insurance quotes, aaa insurance nj, brown insurance tahlequah ok, aaa whole life insurance, auto insurance tahlequah ok, aaa insurance colorado