Ok Google Aaa Auto Insurance – Known for its roadside assistance benefits, AAA also offers auto insurance to drivers in many states. Although these rates are higher than average, AAA members receive benefits in return.

In that time, It is our mission to find simple ways to help our customers save money on the things they need. While we partner with some of the companies and brands we talk about in our articles, all of our content is written and reviewed by our independent editors and is never influenced by our partners. Learn about how we make money, View our editorial standards and refer to our data methodology to learn more about what you can trust.

Contents

- Ok Google Aaa Auto Insurance

- Average Cost Of Car Insurance (2023)

- American Automobile Association

- New Aaa Mobile App

- Aaa Insurance Review

- Csaa Auto Insurance Review 2023

- Aaa Renters Insurance: Is It The Best Choice For You?

- Aaa Roadside Assistance Hi Res Stock Photography And Images

- Cheap Car Insurance W/ No Down Payment — Free Quotes

Ok Google Aaa Auto Insurance

Drivers who need basic auto coverage and are looking for premium discount opportunities or additional benefits may find value in an AAA auto insurance policy. However, not all drivers benefit from AAA’s higher than average rates and limited insurance offerings.

Average Cost Of Car Insurance (2023)

The American Automobile Association – commonly known as AAA – is a collection of auto clubs that operate as a non-profit organization, offering everything from roadside assistance to insurance to drivers across the country. AAA’s auto insurance pairs well with its roadside assistance program by offering drivers comprehensive solutions beyond basic coverage limits.

Teenagers and young drivers may not be able to take advantage of AAA’s generally higher rates, but middle-aged drivers who qualify for discounts can take advantage of bundled opportunities and save even more on their premiums.

Disadvantages include customer complaints about AAA’s limited customer service hours and roadside assistance; But they can overlook the club’s money-saving programs, such as deductible discounts and no-claims discounts.

Some drivers may not think AAA is the top choice for car insurance, but it has a solid reputation in the industry for road-related products. Negative reviews about the roadside assistance program and high average rates in all driver profile categories may cause some drivers to look elsewhere.

American Automobile Association

However, those who appreciate the exclusive membership benefits; Those who qualify for multiple insurance product bundles and premium discounts can benefit from a AAA auto policy.

A company known for its roadside assistance, AAA has a unique feature called the Accident Assist program. It also improves claims beyond industry standards and instantly tows the policyholder to the nearest approved repair center for guaranteed repairs for the life of the vehicle.

In addition to its member benefits and roadside assistance packages, AAA doesn’t offer many auto insurance products that its competitors don’t. with rates higher than AAA’s average; Some drivers may not see the value of paying extra just for better traction or breakdown cover.

It is difficult to consistently assess customer feedback from AAA. If the company is divided into 32 motor clubs; Many online platforms display reviews and testimonials for specific clubs rather than the company as a whole. Still, the general trend is that many consumers have problems with the assistance program. I was mainly stuck on Facebook waiting for a tow truck.

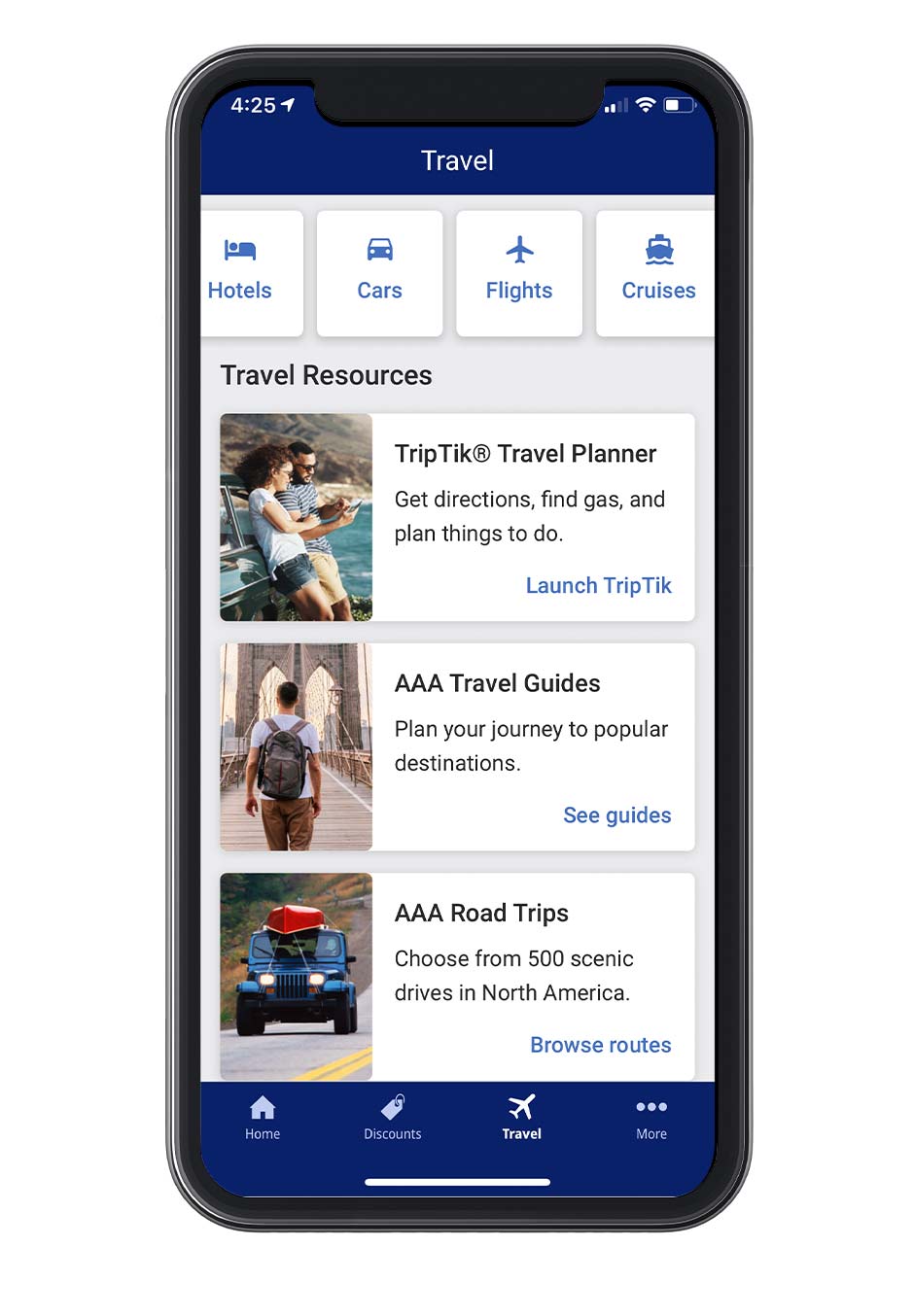

New Aaa Mobile App

Others—like reporting complaints to the Better Business Bureau—detail billing issues through AAA.

Still, there are many positive reviews about AAA – car insurance and their other products. AAA’s Trustpilot profile only has a 1.5/5 star rating, but only 10% of nearly 2,000 reviews are rated 5 stars.

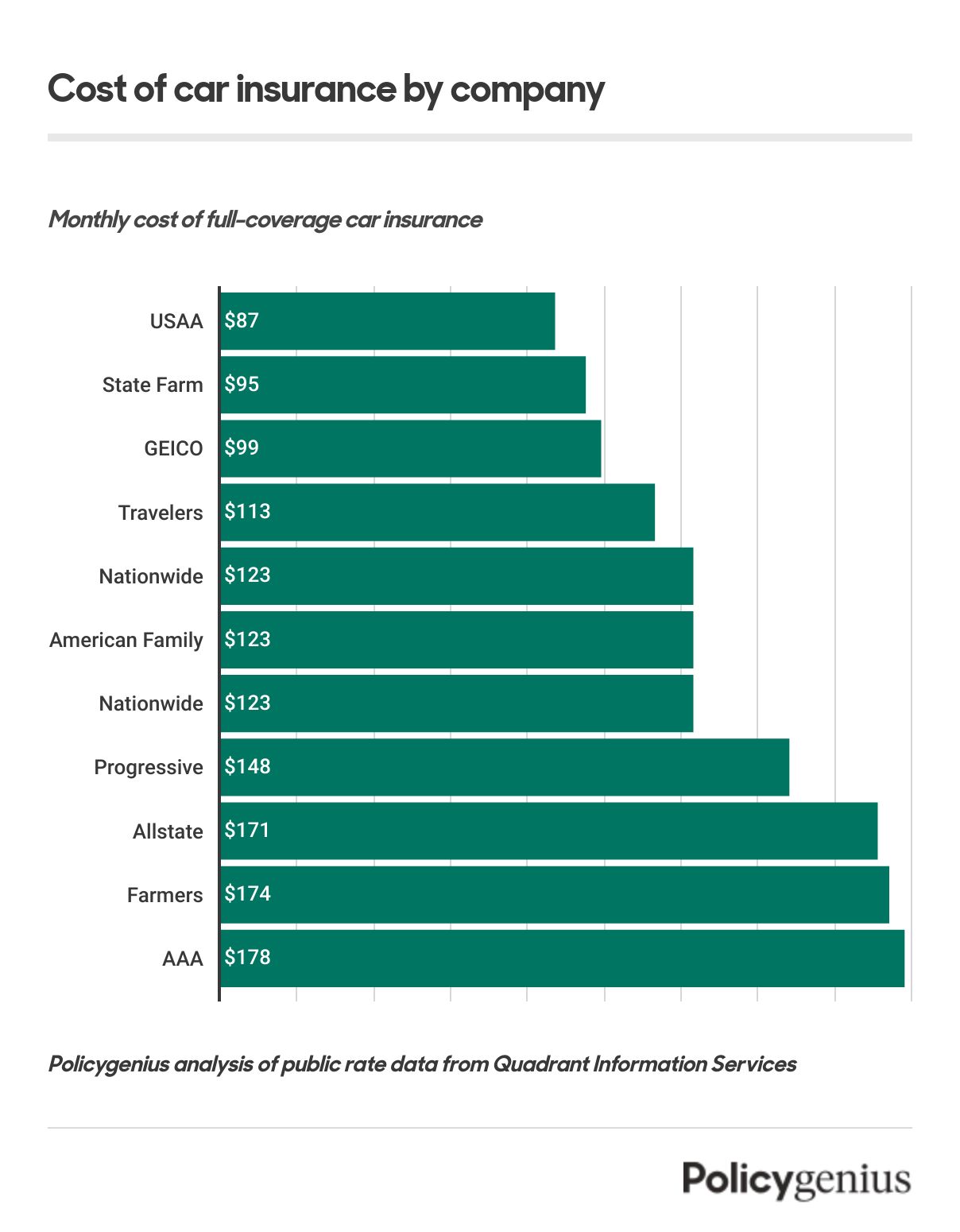

D AAA’s average monthly rates of $314 for more than 160 insurance companies in the United States are significantly higher than the national average of $205. However, It is worth noting that average rates are not a good indicator of what you will offer. your driver’s license age; Your unique profile—including things like your car and other factors—will affect your rate. This can make it higher or lower than the average you see here.

For example, having a clean record can help you get a lower rate than someone who has been in an accident, but other factors, such as your low credit score, can help you get a higher rate offer from the insurance company . That’s why it’s important to always shop around and make deals.

Aaa Insurance Review

Erie, Kemper, Auto-owners and Amica are just a few of AAA’s closest competitors, with Amica offering average rates for both liability and “full coverage” policies.

The table below shows how AAA’s average compares to its competitors. Liability-only policy costs are slightly higher than Kemper’s, but their coverage policies can cost more than twice what Erie costs.

In many cases, comparing liability only and full coverage policies is not an apples-to-apples comparison. Depending on the insurer Coverage coverage will vary based on your state’s minimum coverage laws, and depending on the insurer, a full coverage policy may include optional coverage levels. However, Side-by-side benchmarking is useful in understanding policy price trends.

For example, Amica’s minimum coverage is similar to the average price of Erie’s full coverage. AAA’s average price difference between single liability and full coverage policies is higher than some direct competitors (such as Erie) but lower than others (such as Amica). This further illustrates why it is always a good idea to review different policies from multiple insurers.

Csaa Auto Insurance Review 2023

When shopping online for a AAA auto insurance quote, I was given no options for choosing the coverages I needed or the services available to drivers in my area. However, the quote I received over the phone is as follows.

AAA has a minimum of $25,000 per person and $50,000 per accident; Although you can choose to increase if necessary. Florida (my home state) has a high uninsured driver rate, so they also offer uninsured motorist coverage, which is helpful for me.

Discounts are a great way to lower the cost of your policy; Typically a higher rate, especially if your unique driving profile. AAA advertises 18 discounts, including the following:

Insurers use your age as one of several factors that determine your premium. Even if you have a clean driving record, certain age groups are more likely to be involved in an accident than others. So it’s typical to see rates take a slight U-shaped curve from ages 18 to 65.

Aaa Renters Insurance: Is It The Best Choice For You?

With few exceptions, prices tend to decline with age. for example, Younger drivers under the age of 25 pay more, even if they have been driving for several years, while older drivers pay more because of factors that make them more likely to crash, such as impaired vision and delayed reaction times.

Teen drivers tend to pay more for AAA policies than any other age group — 18-year-olds pay an average of $391 per month for basic insurance and $988 for full coverage policies. On the other hand, 25-year-olds pay an average of $143 per month for liability and $410 for full coverage.

For AAA drivers between the ages of 18 and 25, the rates dropped between 58% and 63% on average. Teenagers have the highest rate of fatal accidents, but with only seven more years on the road, those rates tend to decrease dramatically.

Rates tend to stabilize around age 40, and you’ll notice that rates may increase slightly as drivers enter their senior years. This increase is due to the decline in memory capacity of older drivers; It may be due to frequently used medications or physical limitations that make the accident more likely.

Aaa Roadside Assistance Hi Res Stock Photography And Images

For example, AAA’s average rates for drivers in their 40s are $125 per month for liability only and $355 for full coverage. 65-year-old drivers pay $129 per month for liability and $348 per month for full coverage. AAA shows average rates increase between 2% and 3% once drivers reach retirement age.

Your driving record plays an important role in your policy premiums. Rates may increase if you lose your clean record due to an accident or traffic violation. Below are the average quotes for AAA policyholders with different driving records.

An accidental accident; A speeding ticket and a DUI are examples of high-risk driving that increases the risk of an accident. So getting a speeding ticket or DUI conviction without an accident can raise your rates just as much as being at fault for an accident.

Rates can increase significantly after an accident. AAA’s average rates rose between 55% and 74%, with liability-only rates increasing from $106 to $184 per month and full coverage rates increasing from $320 to $496.

Cheap Car Insurance W/ No Down Payment — Free Quotes

Thank you very much, AAA offers five different benefits for at-fault drivers, depending on their membership plan. Small claims forgiveness will not increase the premium if you claim more than a certain amount. deductible Claiming no-claim rewards and forgiveness programs can also help lower rates over time.

When an AAA policyholder receives an express ticket, Clean drivers can see their rates increase between 38% and 50% with liability-only policies and $320 to $441 policies rising from $106 to $159 to $159 per month. This increase is only for one express ticket, Therefore, multiple tickets may increase your rates even more.

AAA policyholders with speeding tickets on their records should look for discounts with easy qualifications.

Ok google aaa roadside assistance, aaa insurance edmond ok, aaa insurance broken arrow ok, aaa insurance claremore ok, ok google auto insurance, aaa insurance tulsa ok, aaa insurance lawton ok, ok google aaa insurance, aaa insurance enid ok, ok google aaa, ok google aaa com, ok aaa insurance